Mercia is pleased to announce the profitable sale of one of its direct investments, Clear Review, for a total cash consideration of up to £26.0million.

Mercia held a 4.0% fully diluted direct holding in Clear Review at the date of sale and will receive cash proceeds of £1.0million representing a 2x return on its investment and a 72% IRR. In addition to this direct investment return, the sale will also generate an 8x return on Mercia’s EIS managed fund investment cost and a 122% fund IRR.

The company, which was first backed by Mercia’s managed funds in 2018 and became a direct investment in June 2019, has been sold to Advanced Business Software and Solutions, the third largest British software and services company in the UK.

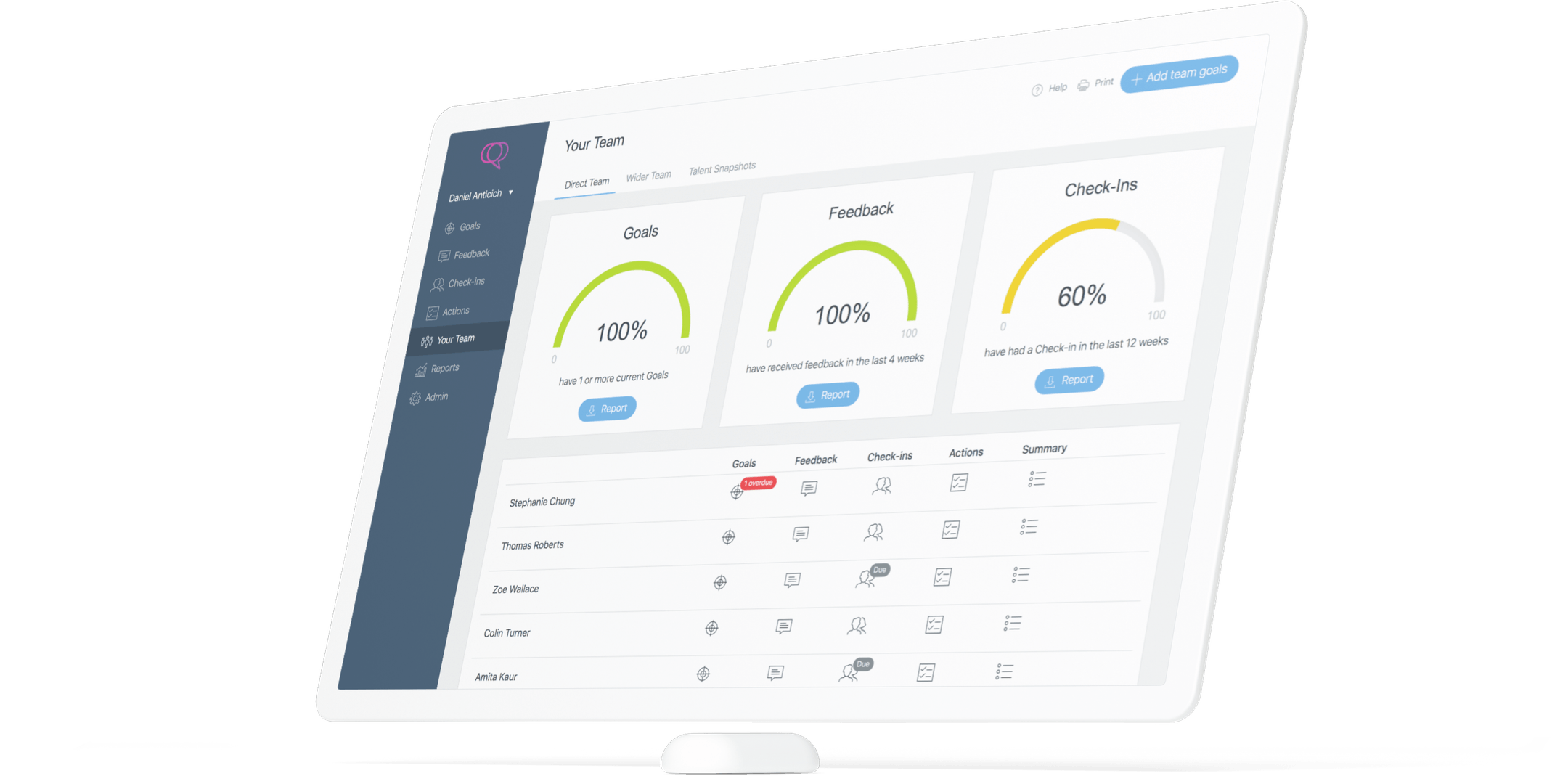

Clear Review, which was founded by Stuart Hearn, former HR director at Sony, is a SaaS tool providing organisations with data and systems to improve performance management. Under Stuart’s leadership the company quickly met its commercial milestones, passing £2.0million in annual recurring revenue in December 2019, up 100% from the previous year. Mercia portfolio director Nigel Owens was a non-executive director from December 2019 until the sale.

Stuart Hearn, CEO of Clear Review, said “We’re extremely proud of the success of our Clear Review platform and its role in improving business performance and developing talent around the world. The acquisition will enable us to accelerate Clear Review’s growth as well as integrate with Advanced’s HR solutions, helping organisations retain their best talent and increase performance.”

Dr Mark Payton, CEO of Mercia Asset Management, said: “Clear Review is now our fifth full cash exit from the direct investment portfolio, coming just three months after we announced the sale of The Native Antigen Company. We have been consistent in our stated objective to both source and exit deals well, and I am pleased that we have been able to again demonstrate our execution of this strategy through another successful exit.

“The team at Clear Review has achieved great things in a relatively short period of time and I am confident that under their new custodian they will continue to disrupt the HR SaaS sector.

“This sale process has been handled entirely virtually, which is testament to our team’s effectiveness in transacting deals even during these complex times.”