“Share price” is mid-market price as at 15 April 2024. “Dividend yield” is based on dividends paid and proposed in respect of latest full financial year, excluding special dividends, expressed as a percentage of share price. Total return statistics are for periods to 15 April 2024, return shown is on £100 invested, based on mid to mid share price/latest published NAV, assuming net income re-invested (source: Morningstar). In accordance with AIC methodology, figures shown over 5 years are based on NAVs excluding current period revenue; and figures shown for 5 years and under are based on NAVs including current period revenue.

Investor area

| Launch date | 2001 |

|---|---|

| Share price | 84.50p |

| Share price total return over 10 years | 192.8 |

| Latest NAV per share | 91.7p (31 December 2023) |

| NAV total return over 10 years | 179.4 |

| No of shares in issue | 148,866,667 |

| Dividend yield | 5.3% |

Introduction

Northern 3 VCT PLC is a Venture Capital Trust established under the legislation introduced in the Finance Act 1995. The fund is a member of the Association of Investment Companies.

The London Stock Exchange code is NTN.L

If you would like to receive a copy of the latest annual and half-yearly reports, by post, please contact us. If you would like to download reports in PDF format, please view the ‘Reports and Shareholder Circulars’ section below.

Marketing of shares to retail investors

We confirm that the shares of Northern 3 VCT are currently ‘excluded securities’ in accordance with guidance issued by the Financial Conduct Authority and can therefore be recommended to retail investors by financial advisers.

Registered office

Forward House, 17 High Street, Henley-in-Arden B95 5AA

Advisers

| Registrars | The City Partnership (UK) Limited |

|---|---|

| Stockbroker | Panmure Gordon (UK) Limited |

| Auditors | Mazars LLP |

Notes

An investment in a Venture Capital Trust (“VCT”) carries a higher risk than many other forms of investment. In addition, the value of an investment in a VCT may go down as well as up and investors may not get back the full amount invested, even after taking into account the tax reliefs. VCTs usually trade at a discount to their net asset value. It may be difficult to exit VCTs and they should be considered as long-term investments. The past performance of the Company is not a reliable indicator of its future performance.

Mercia does not offer investment or tax advice or make recommendations regarding investments and investors will not be treated as clients of Mercia.

More information

Recent Announcements

- Issue of Equity and Total Voting Rights – 4th April 2024

- Total voting rights – 28th March 2024

- Transaction in Own Shares – 21st March 2024

- Offer Update – 12th March 2024

- Transaction in Own Shares – 6th March 2024

- Total voting rights – 29th February 2024

- Net Asset Value – 9th February 2024

- Total voting rights – 31st January 2024

Dividends are usually paid twice a year. An interim in January for the six months to 30 September; and a final in summer for the year to 31 March.

| Next payment date | Dividend per share (p) |

|---|---|

| 17 January 2024 (interim) | 2.0 |

| Previous payments | |

| 18 August 2023 (final) | 2.5 |

| 13 January 2023 (interim) | 2.0 |

| 17 August 2022 (final) | 3.0 |

| 28 January 2022 (interim) | 2.0 |

| 27 August 2021 (second interim) | 4.50 |

| 27 August 2021 (final) | 2.50 |

| 29 January 2021 (interim) | 2.00 |

| 4 September 2020 (final) | 2.00 |

| 24 January 2020 (interim) | 2.00 |

| 19 July 2019 (final) | 2.00 |

| 25 January 2019 (interim) | 2.00 |

| 20 July 2018 (final) | 2.00 |

| 26 January 2018 (interim) | 2.00 |

| 21 July 2017 (final) | 3.50 |

| 21 July 2017 (special) | 5.00 |

| 27 January 2017 (interim) | 2.00 |

| 15 July 2016 (final) | 3.50 |

| 15 July 2016 (special) | 5.00 |

Dividend investment scheme

All of our Northern VCTs offer dividend investment schemes (“DRIS”), which enable shareholders to have their dividends automatically re-invested in new shares rather than being paid in cash. There are no dealing costs and the amount re-invested is eligible for up-front income tax relief at the rate currently applicable to new VCT subscriptions.

You may join the DRIS by completing and returning a scheme mandate form. If you need further information about the DRIS, please contact Mercia on 0330 223 1430 or email vctshareholderenquiries@mercia.co.uk

Completed mandate forms must be returned to The City Partnership (UK) Limited by email or post at the address provided on the mandate form. Alternatively, an online version of the form may be found on the VCT Investor Hub. Please refer to the mandate form and DRIS terms and conditions to confirm the deadline for the return of completed forms.

Dividend payment methods

You may arrange to have dividends paid directly to your bank account by completing a dividend mandate form. Completed mandate forms must be returned to The City Partnership (UK) Limited by email or post at the address provided on the mandate form. Alternatively, an online version of the form may be found on the VCT Investor Hub.

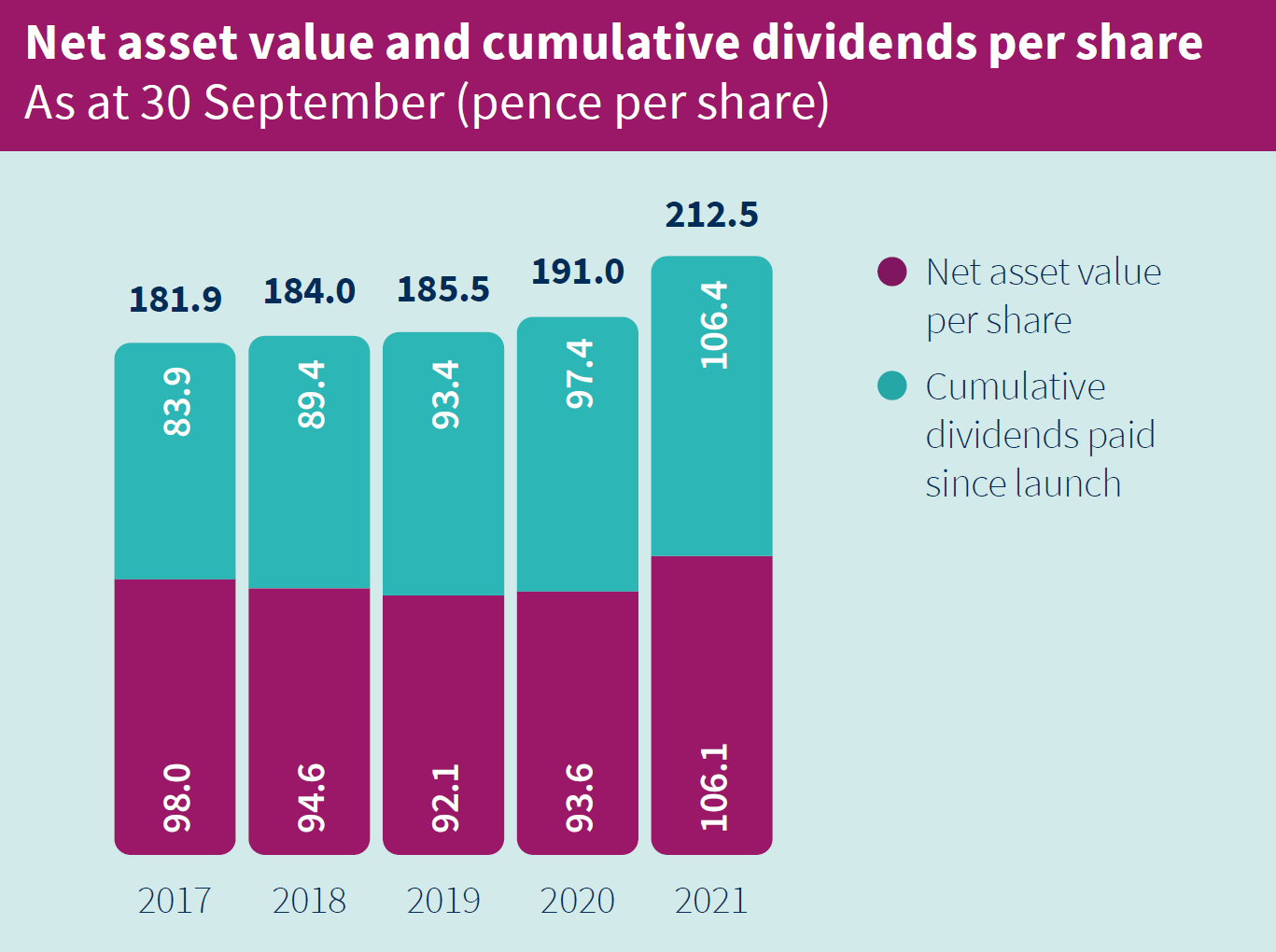

The following charts show the net asset value and dividends (including proposed final dividends) declared in respect of each of the past five financial years on a cumulative basis since inception.

| Launch date | 1995 |

|---|---|

| Share price | 84.50p |

| Latest NAV per share | 91.7p (31 December 2023) |

| No of shares in issue | 148,866,667 |

| Dividend yield | 5.3% |

| 1 yr | 3 yrs | 5 yrs | 10 yrs | ||

| NAV total return | 104.6 | 103.5 | 128.5 | 179.4 | |

| Share price total return | 105.4 | 113.2 | 132.5 | 192.8 | |

“Share price” is mid-market price as at 15 April 2024. “Dividend yield” is based on dividends paid and proposed in respect of latest full financial year, excluding special dividends, expressed as a percentage of share price. Total return statistics are for periods to 15 April 2024, return shown is on £100 invested, based on mid to mid share price/latest published NAV, assuming net income re-invested (source: Morningstar). In accordance with AIC methodology, figures shown over 5 years are based on NAVs excluding current period revenue; and figures shown for 5 years and under are based on NAVs including current period revenue.

Past performance is not a guide to the future and you should be aware that share values and income from them may go down as well as up and that you may not get back the amount you originally invested. Potential investors are strongly urged to seek independent professional advice before considering investment in a VCT. Investments made in smaller companies or specialist sectors such as technology related stocks can be more volatile than investments in developed markets and more established companies and above average price movements can be expected. Exposure to a single country market also increases potential volatility. Investments should be viewed as for the medium to long term. Existing tax levels, bases and reliefs may change and the value of reliefs depends on personal circumstances. Investments made by VCTs will normally be in companies whose securities are not publicly traded or fully marketable and may therefore be difficult to realise, as may the shares in the VCT. In the event of a VCT losing its HM Revenue & Customs approval, it is likely that its shares will become illiquid. Government Stamp Duty of 0.5% is payable on all investment trust shares purchased. The value of investment trust shares purchased will immediately be reduced by the difference between buying and selling prices (market maker’s spread). Performance figures do not include market maker’s spread which can be substantial in these trusts. NVM Private Equity Limited is authorised and regulated by the Financial Conduct Authority.

NVM provides investment management and secretarial services to its client funds in accordance with agreements in place between NVM and each client fund. The fees charged by NVM are set out in the annual reports and accounts of the respective client funds which can be downloaded from the relevant pages on this website see: https://www.mercia.co.uk/investor-area/funds for further information.

The financial calendar for the year ending 31 March 2024 is as follows:

| November 2023 | Interim financial report for the six months ending 30 September 2023 published |

|---|---|

| January 2024 | Interim dividend paid |

| June 2024 | Final dividend and the results for the year to 31 March 2024 announced |

| July 2024 | Annual General Meeting |

| August 2024 | Final dividend paid |

Board committees’ Terms of reference

The latest terms of reference can be viewed by clicking on the following links:

The N3VCT Key Information Document can be found here.

The tagged Annual Report and Accounts for the 12 months to 31 March 2023 can be found here.