Dividends are usually paid twice a year. An interim in January for the six months to 30 September; and a final in summer for the year to 31 March.

Dividend investment scheme

All of our Northern VCTs offer dividend investment schemes (“DRIS”), which enable shareholders to have their dividends automatically re-invested in new shares rather than being paid in cash. There are no dealing costs and the amount re-invested is eligible for up-front income tax relief at the rate currently applicable to new VCT subscriptions.

You may join the DRIS by completing and returning a scheme mandate form. If you need further information about the DRIS, please contact Mercia on 0330 223 1430 or email vctshareholderenquiries@mercia.co.uk

Completed mandate forms must be returned to The City Partnership (UK) Limited by email or post at the address provided on the mandate form. Alternatively, an online version of the form may be found on the VCT Investor Hub. Please refer to the mandate form and DRIS terms and conditions to confirm the deadline for the return of completed forms.

Dividend payment methods

You may arrange to have dividends paid directly to your bank account by completing a dividend mandate form. Completed mandate forms must be returned to The City Partnership (UK) Limited by email or post at the address provided on the mandate form. Alternatively, an online version of the form may be found on the VCT Investor Hub.

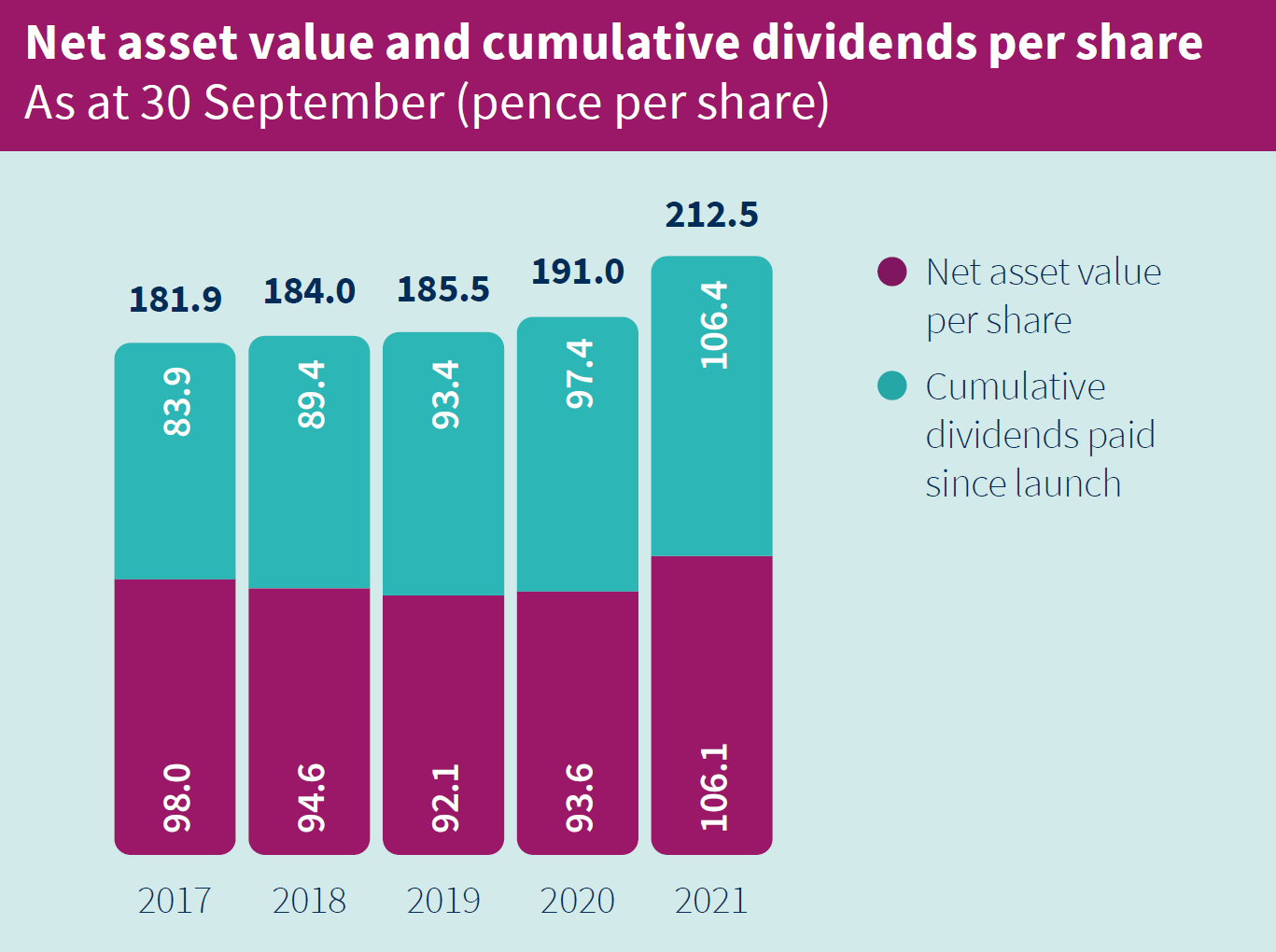

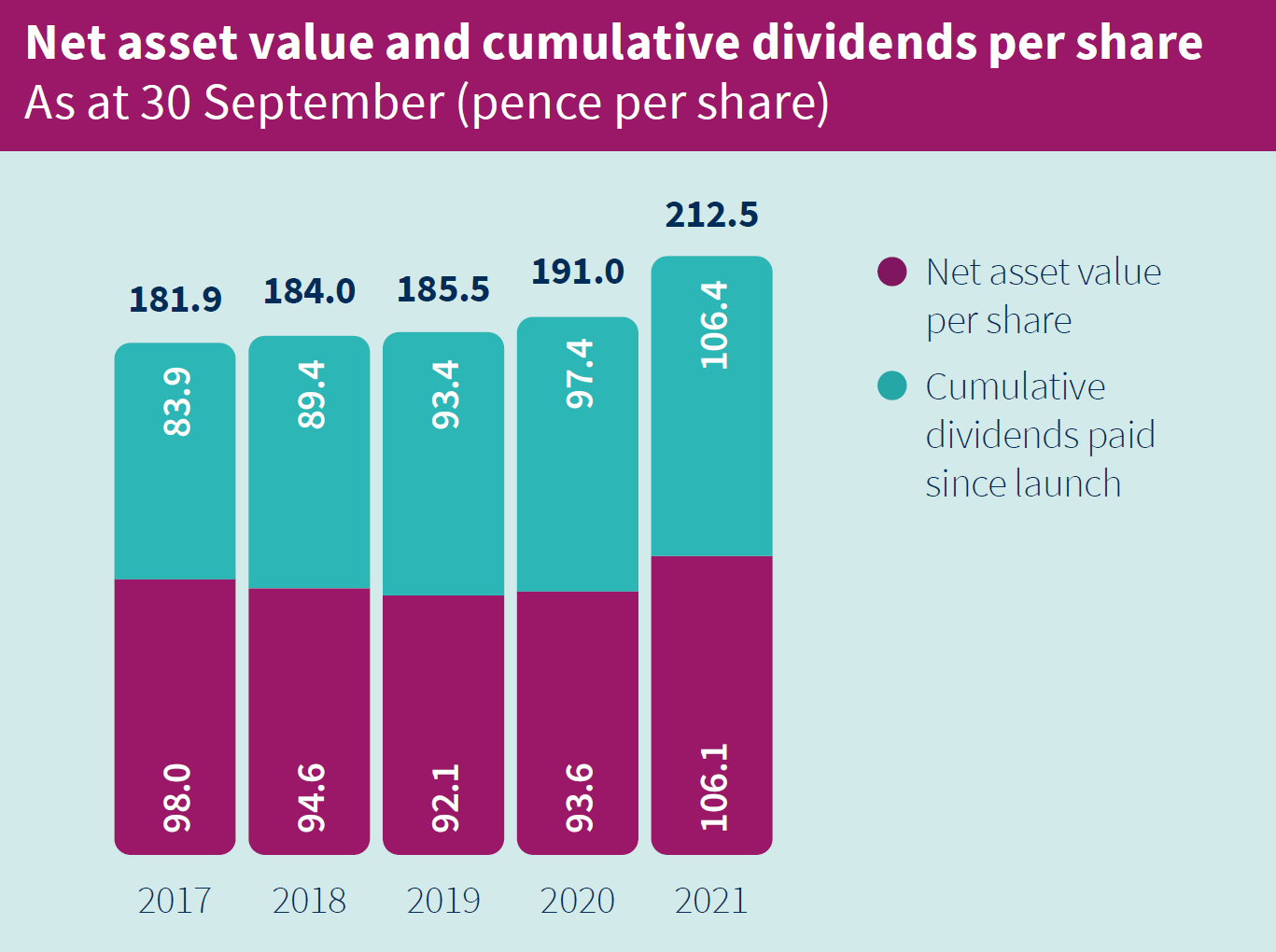

The following chart show the net asset value and dividends (including proposed final dividends) declared in respect of each of the past five financial years on a cumulative basis since inception.